Will Jiang of N5Capital: The Importance of Disciplined VC Investment

Marking Three Successful Years of N5Capital in the VC Industry

On November 9, 2016, N5Capital held a thanks-giving cocktail party to mark the third anniversary of the founding of the company at Hong Kong Jockey Club Clubhouse. More than 100 people attended the cocktail party. For Will Jiang, the cocktail party is not only to celebrate the entry of phase one fund into the exit period, but also to celebrate the surmounting of the first barrier in the past three years since the founding of N5Capital.

In 2016, the VC market entered a cold winter. A great number of funds began to be cautious in investment and would not easily release fund. In the second half of 2015, Will Jiang already vaguely felt that the cold current was around the corner, and intentionally slowed down the pace of investment. Although N5Capital was psychologically prepared long before, a sense of anxiety still spread gradually in the company. Without being able to find good projects and the direction, the team was plunged into the abyss.

Through frequent internal communication, N5Capital completed adjustment in the second half of the year and quickened the pace of investment again in the fields of cross-border tourism, consumption upgrade, and sports. “By far, the development of the projects has all surpassed our expectations,” Will Jiang said excitingly.

Being forty years old, but looking like a thirty-year-old, and having a mentality of a twenty-year-old. This is the comment of Will Jiang on himself.

As a man in his forties, Will Jiang has gone through the phase of agitation when he first engages in investment. Fame and face mean little to him. Since its founding, N5Capital has seldom engaged in external PR and it treats its investees in a low-keyed way. At the official site of N5Capital you cannot find investment portfolio, which is rare for the investment institutions.

“Becoming famous is not a good thing. The investors should pursue long-term return and the enterprises should engage in businesses in a down-to-earth way. It’s not necessary to publicize with a fanfare.”

Will Jiang is rational and cool-headed in many ways. He pursues disciplined investment and would not leave his familiar track to invest in hotspot projects. The operation system of US well-known fund Benchmark is an example in the eyes of Will Jiang. Each person can assume sole responsibility for a certain field. The fund is continuous and it can always find good projects to invest in.

Moreover, having grown up in the US, his talk is sincere, vivid and appealing. During his spare time, he plays games in order to “bring himself closer to post-1990 generation. In order to fulfill his dream as a teenager, he once deposited more than RMB100,000 in a game.

Behind his low-keyed investment, the qualities of reason and sensibility blend on Will Jiang.

The Finish and the Starting Point

In 2013, the market was packed with PE institutions that focus on Pre-IPO phase and a great number of early-stage were thirsty for investment. The market was dull. The demand was growing, but the funds were few.

Under such circumstances, many people saw the opportunities in early-stage RMB fund and some funds with good subsequent development were established at this time, such as Banyan Capital, Joy Capital and Source Code Capital. N5Capital was also established at this time.

As early as the year 2008, Will Jiang developed a keen interest in VC industry. Being good at having dealings with people, understanding the financial situation and having experience of investing in M&A and hedge, Will Jiang believes that VC industry is most suitable to him. At the time, some investment institution offered a job opportunity to him, but Will Jiang rejected the offer, because he had to begin from the lowest level due to lack of experience. This is not what he desires.

Such mode of thinking also reflects in Will Jiang’s future investment style. He prefers the pursuit of long-term planned goals to the present interest.

After five years of accumulation, Will Jiang began to look for institutions to raise fund in 2013. The IPO was not easy. It took Will Jiang and his partner Weiguo Zhao nearly 8 months to raise phase one fund from an institutional investor.

In the spring of 2016, N5Capital completed funding of phase 1 USD fund. In the summer of the year, it completed the funding of phase 2 RMB fund. The fund totals RMB3B. The cycle of the USD fund is 12 years and the investment period is 5 years. The cycle of the RMB fund is 10 years and the investment period is 3years.

As an early-stage fund, such fund structure is slightly different from most of the funds on the market. Such structure is to achieve Will Jiang’s original goal of establishing an inheritable fund.

“If the investment period is only two years, it will be easily dominated by market bubble.”

In the financial industry, most of the businesses are zero-sum games. It’s always true that 20% of the people make 80% of the money. Each person hopes to become one of the 20% people. Will Jiang is no exception. He adopted a counter-cyclical method of investment. In 2015 when the market was hot, he began to slow down the pace of investment, and in the second half of 2016, he quickened up the pace of investment in the cold winter of market.

By far, N5Capital has completed preliminary layout of investment and has invested in more than 50 enterprises in the fields of video, cross-border tourism, consumption upgrade and big data.

Reason, Discipline and Pricing Power

In the eyes of his colleagues, Will Jiang who grew up in the United States is frank and straightforward. As a man of Virgo constellation, he sometimes manifests “extreme coolness” in his work. “Discipline” is a word that he frequently stresses in his talks.

In the eyes of Will Jiang, long-term fund is different from individual investment. From the first day of its founding, strict principles must be put in place. Investment must be made in a disciplined way. Otherwise, the fund will easily leave the familiar track to pursue hotspot projects, hereby losing its own advantages in the new fields.

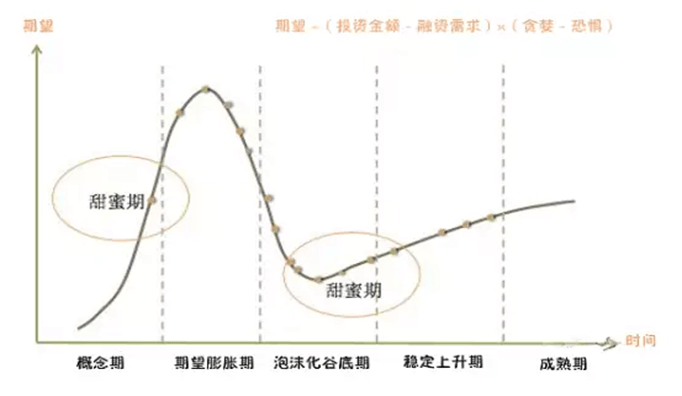

For the fund, the final ROI derives from actual profit rather than the expectation. In pursuit for hotspot projects in the irrational market, avarice will easily overwhelm fear and the expectation is much higher than ROI.

This is a trial for the investor, which involves the game and trade-off between avarice and reason.

“We are more like snipers. I would rather avoid the battlefield in the price war. Instead, I would select the projects that need less fund in the segment market.”

Will Jiang makes a simple calculation. The final ROI of gaining one billion with 100 million is the same with that of gaining 10 billion with one billion. If too much premium is paid in early-stage, the ROI will inevitably slightly drop.

For the projects that can really arouse his interest, Will Jiang develops a “sweet” theory. When the segment fields hit the bottom of the bubble, the investment sweet period of N5Capital comes.

“When the media are all reporting on an industry, do not invest in it. When the media suggest not investing in an industry, say O2O, it’s a good opportunity. ”

In the second half of last year, N5Capital invested in Maxiao Takeout under Spice Spirit. For such thinking out of the box, Will Jiang has his own logic based on careful consideration.

The delicious crawfish becomes overnight a delicacy for friend gathering and midnight snack and the supply can hardly meet the demand. When the demand surpasses the supply, the pricing on the supply side becomes the barrier of competition. Because the source of goods is firmly controlled by China’s suppliers, when there is little difference in C side model, Spice Spirit chooses to expand overseas goods supply channels, which gives greater pricing power to the supply side. Will Jiang believes that Spice Spirit will gain greater ROI among competition of similar products.

One of the key points in Will Jiang’s consideration of the early-stage projects is that as the population dividend dwindles and the economy enters the period of the impending explosion of the stock market, whether it’s possible to effectively improve the gross profit of the industry through high-tech and to gain competitive edge.

Another important focus of N5Capital is industry ceiling. Regarding IPO and overall sale as the goals of exit, N5Capital is demanding on the ceiling in the investment projects.

“Mocha” has changed the user participation method by means of makeup videos and has become a head content generation platform. The woman makeup market is tremendous. Having obtained pricing power by filling the gap in the C side need, Mocha has captivated N5Capital and gained its investment.

Identifying Talents, Investing in Talents and Utilizing Talents

After graduation, Will Jiang’s first job was serving as a consultant in the KPMG of the United States. His boss’s words “I only recruit people smarter than me” have had far-reaching impact on Will Jiang’s viewpoint on talent utilization.

For the early-stage projects, identifying talents is essential. In China, the successful cases of many excellent angel investors are investing in the friends’ entrepreneurship projects, because they are familiar with the friends and know whether they can achieve success in their businesses.

One investment of Will Jiang is for one of his old friends, which finally “gain very high ROI”.

15 years ago, the founder of TalkingData Xiaobo Cui and Will Jiang worked together at a foreign-funded enterprise BEA. The offices of them two were next to each other. After BEA was acquired by Oracle, Will Jiang recommended to a start-up company to serve as CTO. Two years later, the start-up company went bankrupt. The health condition of Xiaobo Cui deteriorated. He was extremely exhausted, so he considered accepting a high-paid position of Oracle.

At the time, Will Jiang admonished Xiaobo Cui that we are born for entrepreneurship. Why not have another try? Based on long-term acquaintance, Will Jiang knows that Xiaobo Cui is sensitive to data and is professional. Although at the time both were not optimistic about the business, Will Jiang still gave TalkingData its first tranche of funding since its founding.

TalkingData founder Xiaobo Cui

“Xiaobo Cui is very charismatic. He has convinced his former BEA colleagues and his former bosses to join his team. He is competent and is good at leading highly talented people. We are dedicated to investing for this kind of people.”

In identifying talents, Will Jiang’s sensibility prevails. If the past of a person is not known, the forecast of his future will be even vague.

For the founders he knows nothing, he would choose to “quietly chat with them and intensively communicate with them”. The topics of their chat range from astronomy, geography, emotional life, work experience to hobbies at the school. There is no standard formula to identify talents. After all, the character of different industry practitioners varies greatly.

But there are several points that Will Jiang emphasizes: Having earned a great amount of money; having suffered losses; and having industry experience.

“It does not mean we should not invest in people with weakness in character. We invest as we usually do. But you must know how to curb the amplification of the weakness. For example, if he is not good at finance. We may allocate money to him or strengthen financial communication.”

With the increase of the investment projects, N5Capital requires more scientific post-investment management. Finance takes up a great proportion in the team of N5Capital. On the team with no more than 20 persons, there is 4 financial personnel. From the standpoint of Will Jiang, the finance of the start-up company is very important and it’s a field in which N5Capital would give professional advice.

Data is another important factor. The team of N5Capital collects the company’s related data through the financial personnel on the team and CEO to carry out analysis and make suggestions.

The Eternal Next Hand of Cards

The greatest inspiration of playing Texas hold’em for Will Jiang is “Remember forever that there is next hand of cards”.

Texas hold’em is one major hobbies of Will Jiang. Will Jiang won the second place in the Texas hold’em competition of the industry and became the only investor among the top three players. The team consisting of Shichun Wu and he became one of the top three in the group competition.

“Texas hold’em truly can reflect the character of a person. The corresponding tactics used should be adopted for different things.”

The auditor seldom has ROI when he plays Texas hold’em due to his rigor in doing things. The success rate of second-tier market practitioners fluctuates sharply. In the process of expansion, they may suffer death in black swan events. VC and the entrepreneurs are usually steady and gain much. The card-playing style of Will Jiang is more close to VC. He enjoys eliminate the factor of luck in calculating his cards.

Playing Texas hold’em is a diversion of the team of N5Capital. But Will Jiang does not like the team member’s playing cards with one method. He thinks that reading the people is the same with reading the card, which must be flexible.

Besides Texas hold’em, the favorite ways of entertainment for Will Jiang are golf and game. Golf helps people wind down and tempers their character. Nevertheless, the game can let people feel they are still young. Sometimes on his way of commuting, he would play the “King of Glory”. As he banters, playing game brings him “closer to post-1990 generation”.

Although he is already in his forties, he is still energetic in his work. Until now, Will Jiang is still able to maintain the pace of inspecting 4 projects each day.

“In the foreseeable future, do you have another plan?”

“I will continue to engage in the fund. I will do it for a lifetime.”

In the second half of 2015, N5Capital slowed down its pace of investment, so it has not invested in VR, AI and other hot fields. Will Jiang said that N5Capital has sufficient ammunition now. The next few months will be a very good period for investment. N5Capital will quicken up its investment again.

“The battle can be most easily won if it’s fought at this time.”

For more information about N5Capital, please contact our team of experts.