Cross-border small agricultural products online trading platform “Chaoliang.com” received tens of millions US dollars in Series A financing, N5Capital invest exclusively | N5·Future

On September 28th, China’s largest cross-border small agricultural product online trading platform, Chaoliang.com, announced that it has completed a tens of millions dollars in Series A financing, which was solely invested by N5Capital. This round of financing will be used for the construction of a standardized warehousing system and the development and upgrading of IT systems. Chaoliang.com has previously received tens of millions RMB in Pre-A round financing led by QC Capital, China Merchants Qihang, Eide Holdings (HK1396) and China-Israel Agricultural Fund.

The establishment of a “standardized warehouse receipt system” in the industry has greatly improved efficiency, and the accumulated trading volume of the platform has reached nearly 20 billion RMB, with annual profits of 10 million RMB

Chaoliang.com was established in 2016. The core team has been deeply involved in the field of small agricultural products in Africa, Central Asia and Southeast Asia for more than 15 years. It is the earliest professional team in the small agricultural product trading industry in China. At present, Chaoliang.com has more than 20,000 service members. As of the end of 2019, the platform has a cumulative transaction volume of nearly 20 billion RMB, and the company achieves tens of millions RMB profit every year. It is the largest cross-border small agricultural product online trading platform in China.

The main characteristics of the small agricultural product industry are: no global monopoly has been formed, and the upstream and downstream of the industrial chain are extremely scattered; there are many practitioners and they are distributed all over the world, with about 1.2 million business households in the world and about 200,000 business households in China; the industrial chain is lengthy, with up to 12 levels; there are problems of information asymmetry and low standardization in the transaction process, and transaction efficiency is low; agricultural product prices fluctuate greatly, and trade defaults, especially cross-border trade defaults, are very serious.

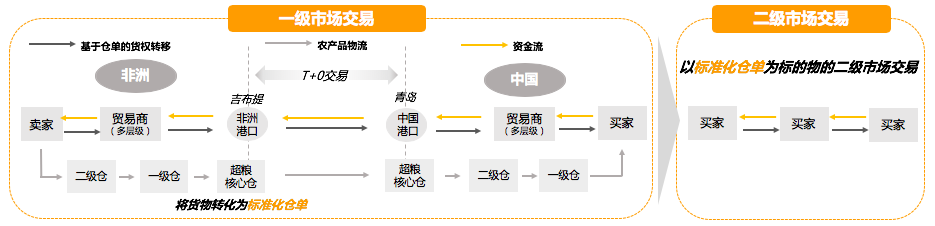

In response to the above-mentioned industry issues, Chaoliang.com has established an electronic trading and standardized warehouse receipt transaction model for agricultural products based on the full supervision of logistics. At the same time, Chaoliang.com has joined hands with China Merchants Port to create a full logistics platform for direct domestic and overseas warehouses. In this way, a credible “warehouse receipt” is formed, and “standardization” + “warehouse receipt” is integrated into a standard warehouse receipt, which has become an industry-recognized transaction standard, leading the development of industry standardization, and greatly improving transaction efficiency.

Trading Diagram of Chaoliang.com

Speaking of GP’s expectations for LP, Will Jiang believes: First, support and trust are what LP has already had since the first day of investment. Second, for domestic investors, a very important point is the relative lack of “patience”- today the secondary market is good. Everyone says that I can make so much money by buying stocks today. I can’t see the return for early stage investments; if the real estate is good, buying a house can earn five times, the fund may not be five times in ten years, this is the Chinese investors’ understanding of the alternative asset definition itself that requires a better understanding of the word “patient”; after all, as a dual-currency fund manager, we are facing Chinese institutional investors and US institutional investors. For the early stage US dollar fund, it started at 10 years period, and can be extended to 12 or even 14 years, but it is really hard for the RMB fund to reach 8 years period. Institutional investors like Yuan He Chenkun have a good understanding of patience, but for other LPs, including LPs who have contact with early-stage investment for the first time, if they don’t have enough patience, this type of asset should not be included in their asset allocation, this is a test of humanity and patience.

Combining with the overseas storage system, Chaoliang.com has deployed in Qingdao, China’s largest small agricultural product port, and established a delivery warehouse of 200,000 square meters for the first phase, forming a trading platform for agricultural products “electronic trading + standardized warehouse receipt + full supervision logistics” , overturning the traditional offline trading methods. The trading platform has realized the “electronic + standardization” trading method from the aspects of product standardization, warehousing and logistics, and electronic trading:

- In terms of product standardization, agricultural products are classified according to their place of origin, category, etc., and standardized color selection, grading, and product traceability are carried out after entering Chaoliang.com’s supervision warehouse, so that the two parties “do not meet or inspect” to complete the transaction;

- In terms of warehousing and logistics, a joint venture company was established with China Merchants Port to be responsible for logistics supervision, and in-depth cooperation with China Storage and Transportation and the Blackstone Group of the United States to increase the regulatory credibility of warehousing and logistics links, and fundamentally eliminate the possibility of bilateral trade defaults;

- In terms of electronic transactions, Chaoliang.com uses warehousing and standardized commodities to form electronic warehouse receipts, manage commodities with codes, and connect WMS and TMS in the whole process. The platform will online commodity pricing, trading, payment, mortgage financing, and visualize logistics. This makes online transactions more convenient and improves delivery efficiency;

Chaoliang.com trading platform not only improves transaction efficiency, but also increases transaction frequency. On the one hand, it can make “buy agricultural products like e-commerce shopping”, on the other hand, electronic trading has created more imagination space for development opportunities. Historically, the cycle of a single cross-border transaction is generally more than 2 months. Now, under the guarantee of full logistics, price fluctuations and high-frequency transactions coexist. On the Chaoliang.com platform, users do not need to wait for the arrival of the goods to complete the next transaction; in other words, as the implementation of “electronics + standardization” matures, some derivative transactions of bulk agricultural products can also be applied in the future small agricultural products field.

China is the largest consumer market and importer of small agricultural products. The “Belt and Road” policy has promoted the rapid development of cross-border small agricultural products transactions.

The global output value of small agricultural products is about 3 trillion US dollars, and China has become the largest consumer country with an annual consumption of about 3 trillion RMB. According to international experience, when the per capita GDP reaches 6,000 US dollars, the cultivation of small agricultural products that are highly dependent on manual labor will no longer be economical, but with the improvement of living standards, the market demand for small agricultural products has increased significantly. Before 2000, China was the world’s largest exporter of small-scale agricultural products, and the attribute of small-scale agricultural products was exports. With the increase in GDP per capita, and under the guidance of the “red line of 1.8 billion mu of arable land” and the agricultural policy that guarantees the production of staple foods, after 2011, China quickly changed from a small agricultural export country to an import country, thus appearing an obvious inflection point of the demand end and supply end market.

Small agricultural products refer to non-genetically modified, no import quota restrictions in China, commercial crops that are mainly characterized by smallholder farming and small traders’ participation, such as sesame, peanuts, peas, linseed, etc., which can be divided into four categories of miscellaneous grains and miscellaneous beans, fats and oils, casual coffee and spices, and more than 100 varieties. In recent years, the annual import growth rate of small agricultural products has reached more than 50%. Take sesame as an example. China used to be the largest exporter of sesame with an annual export value of 500,000 tons, but the current annual import value has reached 1 million tons. At present, most of the sesame seeds consumed in China are produced in Ethiopia, Sudan, Myanmar and other places.

Because small agricultural products are not genetically modified and cannot be planted on a large scale, labor costs and land costs are the core costs. Developing countries dominated by Africa are the main producing areas of small agricultural products and an important source of foreign exchange for local countries. From the perspective of global production area distribution, small agricultural products are mainly produced in Africa, Central Asia, India, Myanmar and other places. At present, the average labor cost in Africa is one-tenth that of China, while the cost of land is less than one percent of China’s, the lowest in the world. Therefore, the cost advantage determines that the planting area of small agricultural products is shifting from the world to Africa, and the scale of small agricultural products in Africa is expanding rapidly. Take Nigeria as an example, small agricultural products have not been planted 10 years ago, and now they have exported more than 250,000 tons per year.

Because small agricultural products are not genetically modified and cannot be planted on a large scale, labor costs and land costs are the core costs. Developing countries dominated by Africa are the main producing areas of small agricultural products and an important source of foreign exchange for local countries. From the perspective of global production area distribution, small agricultural products are mainly produced in Africa, Central Asia, India, Myanmar and other places. At present, the average labor cost in Africa is one-tenth that of China, while the cost of land is less than one percent of China’s, the lowest in the world. Therefore, the cost advantage determines that the planting area of small agricultural products is shifting from the world to Africa, and the scale of small agricultural products in Africa is expanding rapidly. Take Nigeria as an example, small agricultural products have not been planted 10 years ago, and now they have exported more than 250,000 tons per year.

Countries in Africa and Central Asia have a weak industrial base, and small agricultural products are an important source of foreign exchange earnings from exports. With the continuous advancement of China’s One Belt One Road policy, economic and trade exchanges between China and related countries have become increasingly frequent. China’s investment in infrastructure and the sale of “Made in China” products in local countries is used to achieve trade balance and capital return through small agricultural products. The logic of “bartering goods” will enable greater development of bilateral trade. The CIIE will further increase the export of large and small agricultural products to China.

Pu junchen, managing director of N5Capital, said, “The policy background of the continuous escalation of international cooperation on the Belt and Road has led to increasingly close economic and trade exchanges between China and related regions. Chaoliang.com’s deep cultivation in the field of cross-border small agricultural products has formed a very high industry barriers, it has become China’s largest online trading platform for small agricultural products, and it has captured the key resource positions for trade between countries in the region and China. The electronic trading model of small agricultural products created by Chaoliang.com brings changes to the industry and has improved the efficiency of industry transactions. The current company model has been verified. Through this round of financing, the company will replicate at a better pace, and is expected to become the world’s largest small agricultural product trading center based on China.”